By Carissa D. Siebeneck Anderson & Jon DeVore

We recently posted an article (see below) regarding recent legislation impacting how small business size will be calculated. Congress passed the Small Business Runway Extension Act that changed those calculation requirements—previously, size based on gross receipts (revenue) was calculated based on at least a 3-year average, and the new legislation changed 3 to 5 years. We hoped that SBA would issue guidance clarifying when and how the changes to the size standards would take effect.

Well, SBA has issued an internal notice, but the distribution of that notice was delayed due to the government shutdown, but it is making its way into the public sphere slowly. Not everyone will be happy with SBA’s reaction to this legislation – which is basically to put on the brakes.

SBA states:

“The Small Business Act still requires that new size standard be approved by the Administrator through a rulemaking process. The Runway Extension Act does not include an effective date, and the amended section 3(a)(2)(C)(ii)(II) does not make a five-year average effective immediately.

The change made by the Runway Extension Act is not presently effective and is therefore not applicable to present contracts, offers, or bids until implemented through the standard rulemaking process. The office of Government Contracting and Business Development (GCBD) is drafting revisions to SBA’s regulations and SBA’s forms to implement the Runway Extension Act. Until SBA changes it regulation, business still must report their receipts based on a three-year average.[1]

While it is a useful step in the right direction that SBA has provided clear guidance (internally), this will not end the confusion. First, SBA has not issued public guidance, which we hope they will do soon—perhaps in the form of press release or other quick release method once the SBA’s doors are officially open again. Second, the way that the statute was changed and the lack of an effective date or implementation guidance within the legislation did leave things a bit ambiguous as to legislative intent as to how the size standard would be implemented. Any line-item change to the requirements in this statute could have caused a similar problem, because of how the statute itself is phrased. With arguable ambiguity in statutory interpretation comes agency discretion in interpretation. While reasonable minds could certainly disagree with SBA’s interpretation, the agency will likely enjoy a significant degree of discretion in interpreting statutes applicable to itself, especially as the SBA is charged with implementing the size standards generally throughout the federal government. SBA could also have reasonably interpreted the change to be effective immediately or issued an implementation date. (See, 15 U.S.C. § 632(a)(2)(C)(ii)(II), which is the Section 3(a)(2)(C)(ii)(II) of the Small Business Act. (Linked below.)) Instead, we will all have to wait for SBA to issue new regulations. This uncertainty highlights the need for stronger coordination in the future between small business advocates in Congress and the SBA to ensure a smoother implementation.

Statutory Change – Excerpt from 15 USC 632

While it may be somewhat unpopular with some, SBA measured approach does have some merit and potential benefits. One advantage to this approach, is that SBA will be able to give more guidance as to how and when to implement the change when it does go into effect.

Potential Legal Challenge? Others may disagree with SBA’s interpretation of the statute and its effective status. SBA’s interpretation could be legally challenged in the form of a size protest appeal before OHA or other similar action. It would be interesting to see whether OHA would agree with the SBA’s interpretation that the statute is not effective immediately, but instead only goes into effect upon completing the formal rulemaking process and obtaining administrator approval. (These other components are also criteria that must be met under the statute along with the now 5-year average period for size calculation.)

SBA Recommends Maintaining the Status Quo…So, we would not recommend changing how your business calculates its size just yet (i.e. stick to the 3-year average for now), unless you intend to wage a legal fight to test SBA’s discretion and interpretation. In the meantime, we must sit and wait for the regulatory process to be completed on SBA’s timeline. That timeline is uncertain in the best of times, but especially now amidst the ongoing and record-breakingly long government shutdown.

Get your comments and questions ready. While SBA has not opened up a formal comment period, business might consider whether they have any questions about how the change should/will impact their business. Those comments and questions should be collected and submitted to SBA during the mandated comment period that must precede any final regulations in the size standard area.

[1] SBA Information Notice 6000-180022, Small Business Runway Extension Act of 2018, to all GCBD (Office of Government Contracting and Business Development) Employees (Effective 12-21-2018) (emphasis added).

Related Post: Originally posted on January 4, 2019.

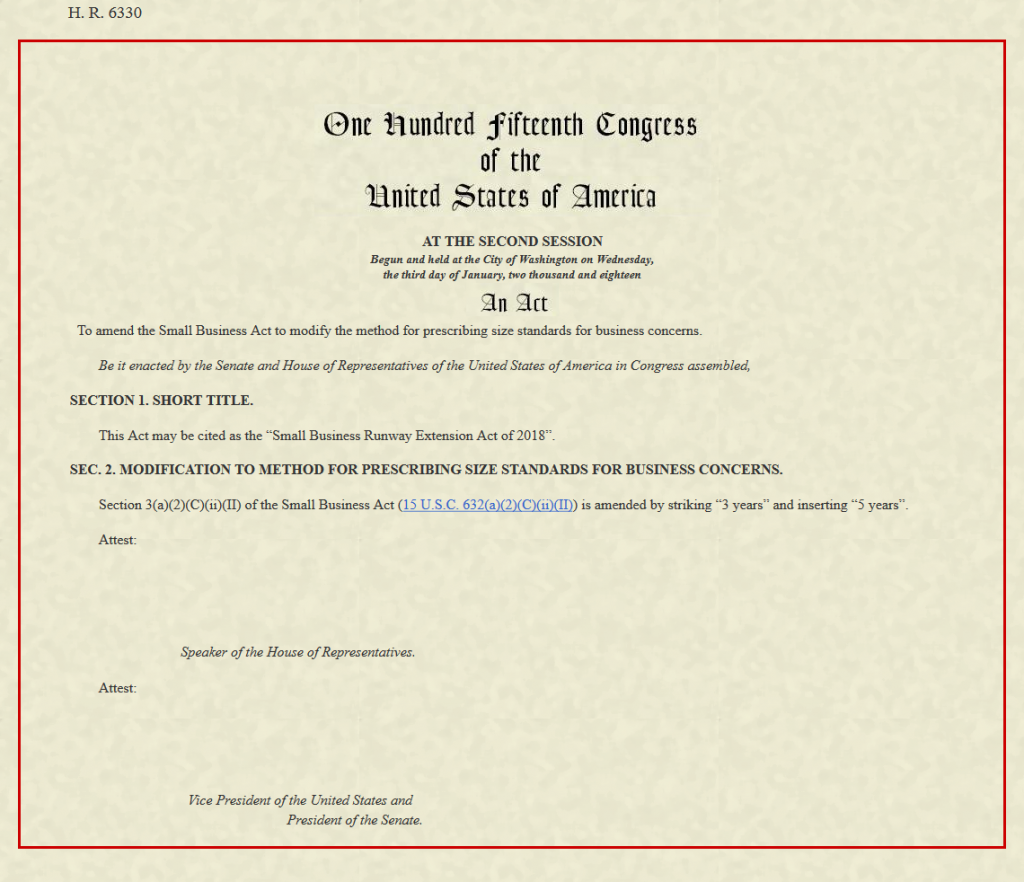

Congress has changed how small business size will be calculated. At the end of the year, both the House and Senate passed the Small Business Runway Extension Act of 2018 (H.R. 6330/S. 3562). This brief but important piece of legislation was signed into law on December 17, 2018.[1]

Currently, small business size is calculated based on the average annual receipts (or number of employees depending on the NAICS Code) of the business over the most recently completed three fiscal years.[2] The new bill expands the average calculation to include the last five years.[3]

Impact – Longer Small Business

Eligibility Period & More Small Business Competition. This noteworthy change will extend the

potential period of small business eligibility. It will decrease the impact of one uncharacteristically large year. This change is likely to be a welcome change for small businesses, and potentially even make some former small businesses eligible for small business programs again. It should be noted that extending the period of eligibility will also likely increase competition for small business contracts, as most small businesses will remain eligible for small business procurements for longer. Thus, the small business community benefits by getting (potentially) longer periods of small business eligibility, and the government benefits from an increased number of small businesses and thus increased competition for small business contracts. This should also make it easier and more cost-effective for agencies to reach their small business procurement goals.

Expect A Period of Confusion. The legislation did not include any timelines for drafting implementing regulations. There is likely to be a period of confusion while the statute is out-of-sync with the regulations regarding calculation of size. We would strongly encourage affected businesses to contact SBA to encourage the agency to issue public guidance for small businesses and contracting professionals on how to handle the transition period. It is clear that as the statute has been updated, it trumps any conflicting regulations. The SBA will take some time to update its regulations. However, small businesses that plan to utilize the new formula should be prepared to explain and cite the new law (and its binding legal effect despite conflicting regulations that need to be updated to reflect the revised statute). Entity-owned businesses may also need to update other business tools and processes, such as tools that track business revenue by specific NAICS Codes for size purposes and to avoid multiple businesses in the same NAICS Codes, which will also become even more critical and potentially confusing.

Please contact Carissa D. Siebeneck Anderson or Jon DeVore at BHBC if you have any questions about how this new law will affect your business.

[1] Public Law No: 115-324, available at https://www.congress.gov/bill/115th-congress/house-bill/6330.

[2] See Small Business Act (15 U.S.C. 632(a)(2)(C)(ii)(II); 13 CFR 121.104(c) Period of Measurement.

[3] H.R. 6330: “Section 3(a)(2)(C)(ii)(II) of the Small Business Act (15 U.S.C. 632(a)(2)(C)(ii)(II)) is amended by striking ‘3 years’ and inserting ‘5 years’.”