Written by Carissa D. Siebeneck Anderson

The U.S. Small Business Administration (SBA) has been busy. SBA has released several rules lately, and more are coming. If you were hoping that SBA would increase the size standards for your receipt-based NAICS code, you are in luck. If you were close to sizing-out and you were hoping for an immediate increase of the higher size standard, then it really is your lucky day.

On July 18, 2019, SBA issued an interim final rule to raise its monetary size standards to adjust for inflation. This rule (including many new size standards) went into effect on August 19, 2019. Please note that SBA is also still accepting comments on this rule. The comment deadline is September 16, 2019, and comments can be submitted online at https://www.regulations.gov/docket?D=SBA-2019-0008.

Why is SBA adjusting is size standards? In order to fulfill both statutory and regulatory requirements to periodically review its size standards for inflation, SBA completed the review and has decided to adjust its monetary-based industry size standards (but not those based on employee numbers) for the inflation that has occurred since the last inflation adjustment, which was published in June 2014.

As result, adjustments were made to 518 industries and 9 subindustries that use receipts-based standards as well as 5 industries that use assets-based size standards. SBA also took this opportunity to adjust two program-specific receipts-based size standards for sales/leases of government property and stockpile purchases. SBA issued this inflation adjustment as an interim final rule, so that small businesses will get the benefit of the higher size standards as soon as possible, even though SBA plans to review (and potentially adjust) its size standards again in the near future based on its 5-year review of industry and Federal market conditions.

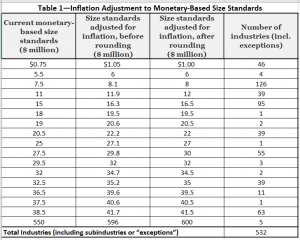

How much is the inflation adjustment? SBA found inflation of 8.37% for all receipts-based size standards (except the agricultural standard discussed below), so SBA adjusted those standards by multiplying the current size standards by 1.0837; SBA then rounded the result to the nearest $500,000. SBA found a 40.26% inflation adjustment was warranted for the $750,000 agricultural size standard, so SBA multiplied those 46 agricultural industries with a size standard of $750,000 by 1.4026 and rounded to the nearest $500,000, resulting in a new standard of $1,000,000 for all 46 agricultural industries.

Below is a re-creation of Table 1 from the Interim Final Rule. It demonstrates the specific impact of the inflation adjustment on size standards of varying levels. The third column shows the newly adjusted size standards, including SBA’s adjustments made for rounding.

The Rule at a Glance information below includes a link to the rule, which includes a full copy of the affected size standards. If you have any questions about this rule, how to calculate your business’s size, or how this rule may impact your business, please contact Carissa D. Siebeneck Anderson or Jon DeVore.

Rule at a Glance

Citation: Small Business Size Standards: Adjustment of Monetary-Based Size Standards for Inflation, 84 Fed. Reg. 34261 (July 18, 2019).

RIN: 3245-AH17

Docket ID: SBA-2019-0008

Effective Date: August 19, 2019

Comment Deadline: September 16, 2019

Link to Rule: https://www.federalregister.gov/documents/2019/07/18/2019-14980/small-business-size-standards-adjustment-of-monetary-based-size-standards-for-inflation#