Written by: Carissa D. Siebeneck Anderson

Joint ventures have always been a popular tool for small businesses, but with the introduction of the All Small Business Mentor Protégé Program, joint ventures seem to be even more common. There has been much discussion of the SBA’s subcontracting limitations, but calculating compliance can get a little tricky when dealing with joint ventures.

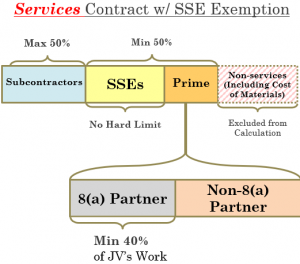

Small businesses may form joint ventures authorized under the Small Business Administration (SBA) regulations. When performing covered small business contracts, small business prime contractors must adhere to subcontracting limitations. In the case of a joint venture (JV) performing a covered small business contract, the JV must adhere to two levels of limitations. For purposes of compliance with subcontracting limitations, the JV is considered the Prime, so the work done by both/all JV partners will determine how much work is performed by the “prime” compared to subcontractors. See 13 CFR 125.6. In addition, the JV partners must comply with the performance of work limitations applicable to the individual JV partners.

Small Business Subcontracting Limitations. For covered small business service contracts, the JV must perform at least 50% of the amount paid out under the contract. Materials are first excluded, then the 50% applied to the remaining total under the contract. If the JV is utilizing any similarly situated entities (SSEs), any SSEs’ work may be combined with the JV’s amount of work to achieve the 50% minimum of work. Other contract types require the prime to perform different minimum amounts of work: construction (15%), specialty construction (25%), and supplies (50% but see rules for non-manufacturers 125.6).

JV Performance of Work. JVs must also ensure compliance with a second level of requirements that apply to the amount of work that the small business/8(a) must perform of the JV’s work. We will call this a performance of work limitation to distinguish it from the generally applicable small business subcontracting limitations above. For example, in a JV between a big business mentor and its 8(a) protégé under SBA 8(a) Mentor Protégé Program (MPP), the 8(a) protégé must perform a minimum of 40% of the work performed by the mentor-protégé JV. It is important to note that the protégé must also receive profits commensurate with its work performed and the protégé must own a minimum of 51% of the JV. Thus, while the minimum performance of work is only 40%, in practicality we recommend that proteges plan to perform 51% of the JV’s work (or work up to 51% during the contract term) to earn 51% of the profits of the JV. This is not required, simply recommended. The same 40% minimum of the JV’s work applies to joint ventures under the All Small MPP and to joint ventures between non-MPP 8(a) and non-8(a) concerns under the 8(a) Program.

The following example illustrates the combination of limitations. On a services contract, if the MPP JV (as prime) performs the 50% minimum of the contract award amount received by the JV contractor, and the protégé performs the 40% minimum of the work done by the JV, then the protégé performs 20% of the services portion of the contract value overall.

If you have any questions regarding how these rules apply to your business, please contact Carissa D. Siebeneck Anderson ([email protected]) or Jon M. DeVore ([email protected]), or via phone at office.